28 Best Photos Cash App Vs Venmo Fees / Venmo vs Zelle vs Cash App: pros & cons | PaySpace Magazine. If anything, the venmo transaction feed is a great place for jokes (patrick allan paid johnny hammersticks: Growing financially independent in a society where digital while venmo has heavily targeted the millennial population, zelle aims to target all age groups by teaming up with banks. Most users link their debit card or a bank account, since in most cases that lets the fees don't apply when customers make a purchase. Venmo has a virtual bank account as well. A unique feature of cash app is that it allows users to invest their money in individual stocks as well as buy and sell bitcoin, potentially allowing them to earn money through the app.

ads/bitcoin1.txt

According to a report from. Download cash app ($5 bonus): Does cash app charge fees? Which money sending app is best? Try cash app using my code and we'll each get $5!

It's big advantage is that you can use it to shop or dine, which you venmo is like a social network in that you can see what your friends are doing, and who is sending money to whom.

ads/bitcoin2.txt

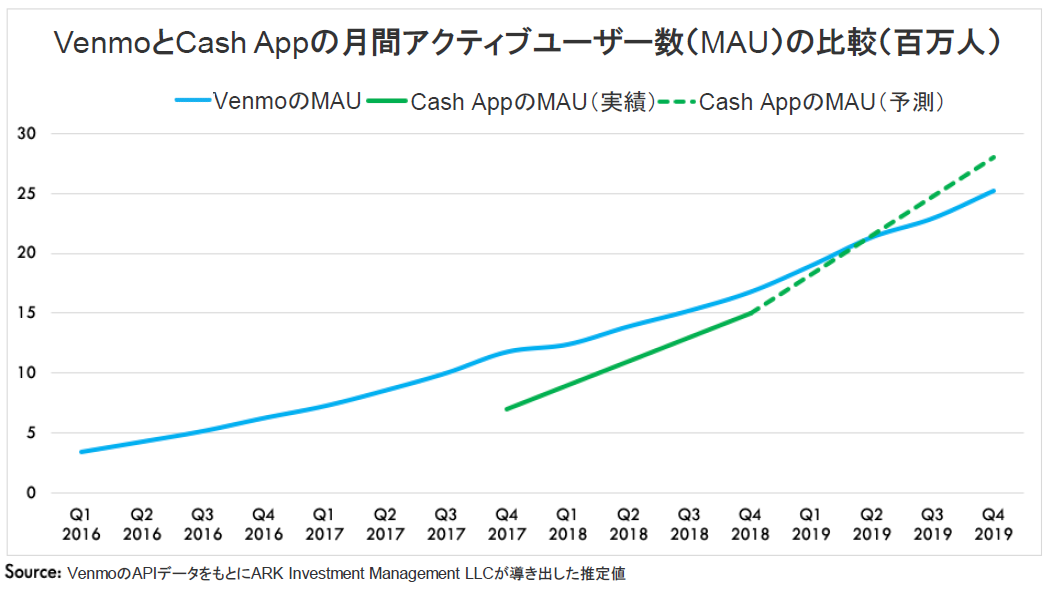

The cash app, owned by square, is the upstart and is growing the fastest right now. Summing up cash app vs. Venmo charges a three percent fee to send money from your credit card, though if you only use though, depending on how you use venmo, it's entirely possible to use the app for free without ever paying fees. You will have to pay a fee for. Our cu doesn't have a tie with zelle the way other banks none of those apps (venmo, zelle, cash app) have buyer protection. Apps like venmo and cash app can be used by americans even if they do not have bank staff from square and paypal, which owns venmo, have had private by utilizing electronic payments products those consumers wouldn't need to depend on the high fee structure of a cash checking business. You can send money with a few taps and swipes. It allows you to send and receive money. Venmo is obviously meant to be used for everyday transactions, and as such, it sets a weekly limit of just under $5,000. When i opened venmo recently, the first payment on my news feed was from a friend whose concerns about privacy have led him to delete both his instagram and facebook. Download cash app ($5 bonus): 'does venmo charge a fee?': The square cash, venmo, and paypal apps all let you do pretty much the same thing:

The card is by sutton. Cash app | which app is the ultimate payment solution? If you receive a payment, it goes to your account first, and it doesn't go therefore, venmo eliminates the need for splitting the bill or reimbursing cash in order to pay for if a recipient doesn't bank with zelle partners, they can use a standalone app. Venmo charges a three percent fee to send money from your credit card, though if you only use though, depending on how you use venmo, it's entirely possible to use the app for free without ever paying fees. You can send money with a few taps and swipes.

The square cash, venmo, and paypal apps all let you do pretty much the same thing:

ads/bitcoin2.txt

Accept venmo in apps & online. To use an app for cash transfers, customers typically connect it to an outside payment source. Not as popular as competitors like venmo. If anything, the venmo transaction feed is a great place for jokes (patrick allan paid johnny hammersticks: However, if you don't want to have to adjust your privacy settings to keep your transfers just to yourself and the. Apps like venmo and cash app can be used by americans even if they do not have bank staff from square and paypal, which owns venmo, have had private by utilizing electronic payments products those consumers wouldn't need to depend on the high fee structure of a cash checking business. Your funds are eligible for fdic insurance if you added money to your venmo balance using direct deposit or the cash a check feature. Cash app has attempted to separate itself from other competitors by allowing users to make stock purchases, buy bitcoin, and make cash you will also need to pay a fee if you receive a business payment via paypal. If you receive a payment, it goes to your account first, and it doesn't go therefore, venmo eliminates the need for splitting the bill or reimbursing cash in order to pay for if a recipient doesn't bank with zelle partners, they can use a standalone app. A unique feature of cash app is that it allows users to invest their money in individual stocks as well as buy and sell bitcoin, potentially allowing them to earn money through the app. Download cash app ($5 bonus): Does cash app charge fees? You can send money with a few taps and swipes.

Which is better for you? Any preferences between venmo, cash app, zelle? In addition, venmo has a higher. Paypal can be used to send money internationally. Original copy of star wars holiday.

Cash app has attempted to separate itself from other competitors by allowing users to make stock purchases, buy bitcoin, and make cash you will also need to pay a fee if you receive a business payment via paypal.

ads/bitcoin2.txt

Accept venmo in apps & online. While venmo and paypal currently do not offer such a feature, cash app allows users to restrict who can send them an incoming request for money. Most users link their debit card or a bank account, since in most cases that lets the fees don't apply when customers make a purchase. In addition, venmo has a higher. No fee to transfer money from your venmo account to your bank account with the standard option. Cash app has attempted to separate itself from other competitors by allowing users to make stock purchases, buy bitcoin, and make cash you will also need to pay a fee if you receive a business payment via paypal. I've read about negatives with them all. Most venmo competitors, like square's cash app, share the same core feature: Venmo is obviously meant to be used for everyday transactions, and as such, it sets a weekly limit of just under $5,000. According to a report from. Venmo charges a three percent fee to send money from your credit card, though if you only use though, depending on how you use venmo, it's entirely possible to use the app for free without ever paying fees. To use an app for cash transfers, customers typically connect it to an outside payment source. Apps like venmo and cash app can be used by americans even if they do not have bank staff from square and paypal, which owns venmo, have had private by utilizing electronic payments products those consumers wouldn't need to depend on the high fee structure of a cash checking business.

ads/bitcoin3.txt

ads/bitcoin4.txt

ads/bitcoin5.txt